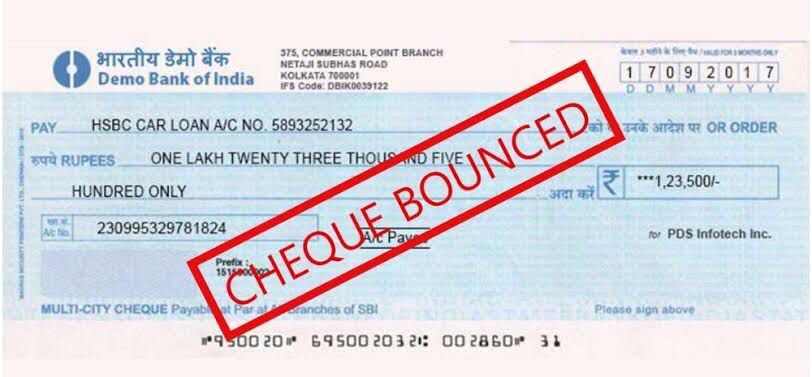

Reasons for check Bounce ?

- Insufficient Fund

- Signature mismatch

- Account number mismatch

- Disfigured or damaged check

- Stop Payment

- Overwriting

what is the penalty of check bounce?

Is a bounced check a criminal offence.If a check is dishonoured due to insufficient fund in India, the person who issued the check will have committed a crime. Check bounce offences are punishable by up to two years in prison, a fine equal to twice the value of the check, or both.

Check Bounce Charges ==>

When a bank declines to honour a check that was used to make a payment, the words ‘insufficient fund’ or ‘dishonoured check’ or ‘check bounce’ are used. The bank also charges a specific amount as a fee from the clients for cheque bounce.

Check Bounce Penalty by Popular Banks ==>

SNo. Bank Charges

1- SBI – Check/bill deposited with SBI returned unpaid by others (outstation/ local)

Check/bill up to ₹1.00 lacs – ₹150/- + GST

Check/bill above ₹1.00 lacs – ₹250/- + GST

Check Returned Entries for check carried on SBI (for inadequate funds only) (for all segments)

₹500/- + GST (irrespective of the cost)

Check returned costs for check carried on SBI (for professional reasons) for all shares when the customer is at mistake.

₹150/- + GST

2-HDFC Bank

Saving A/c

Outward: ₹100/-

Inward: First check results in a quarter – ₹350/-. From another check return in the same direction – ₹750/- per return

Current A/c

Outward: ₹50/-

Inward: ₹300/-

Dishonour of Outstation Cheques

Automatic Savings

Outward: ₹100/-

Inward: ₹350/-

Senior Citizen Account

Outward: ₹80/-

Inward: ₹350/-

3-ICICI Bank – Local Charges

Cheque placed by the client – ₹100/- (for all check return for commercial reasons)

Check declared by the customer –₹350/- (for one cheque return per month); ₹750/- per statement in the same month for business or financial reasons. ₹50/- for non-financial purposes except for signature confirmation for each cheque return for business reasons.

Outstation Charges

Outstation check collected by the client – ₹150/- + other bank charges at actuals per check.

4-Axis Bank

Return of cheques collected at the home branch for limited clearing – ₹500/- per cheque

5-Bank of Baroda

Check(collected by BOB’s client and returned overdue (Inward Return)

Up to ₹1 lac – ₹125/-

Above ₹1 lac to less than ₹1 crore – ₹250/-

Above ₹1 crore – ₹500/-

Check(carried on BOB) paid (Outward Return)– (Financial Reason)

Up to 1 lac – ₹250/-

Above ₹1 lac to less than ₹1 crore – ₹500/-

For ₹1 crore and above – ₹750 per instrument

In case the bank continues out of funds; original interest is at 7.5% over base rate is to be credited extra

For other reasons – ₹250/-

Why choose vakil sathi ?

Vakil sathi has the best team of advocates in all India who can provide you clear insights and support you through check bounce cases. You can also get in touch with our banking experts to avoid check bounces in future. Talk to our experts right away and get cleared of all your doubts related to check bounce cases.