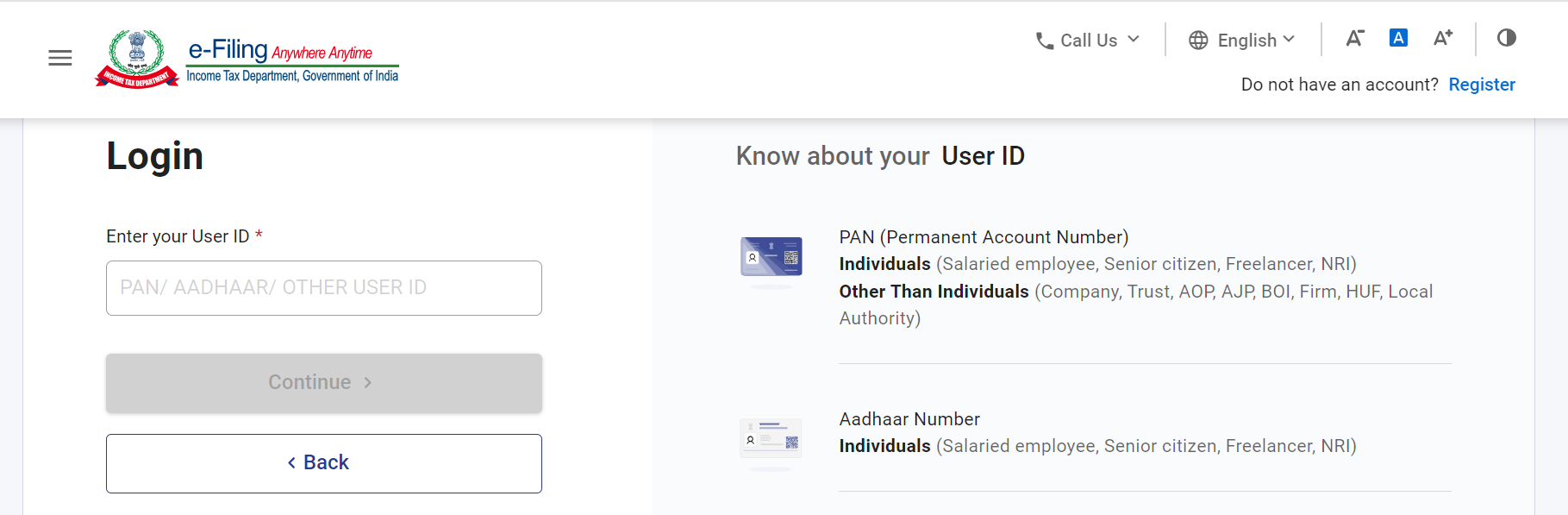

E-filing refers to the process of filing Income Tax Return (ITR) online, using the Income tax portal https://eportal.incometax.gov.in/iec/foservices/#/login

The Income Tax Department provides the facility for e-filing of an income tax return. Before discussing the steps involved in the e-filing of ITR, it is essential for a taxpayer to keep the following the documents for e-filing their ITR. - PAN - From 26AS, AIS - Bank Statements - Form 16

What is form 16 ?

Form-16 is the TDS certificate issued by your employer when they deduct TDS. When

an employer deducts TDS on salaries, the income tax act requires that a certificate is issued by the employer, where the details of tax deducted and deposited are certified.

There are some Steps Guide on How to E-file ITR on Income Tax Portal.

- Step 1: Login

- Step 2: Go to ‘File Income Tax Return’

- Step 3: Select the right ‘Assessment Year’

- Step 4: Select status

- Step 5: Select ITR type

- Step 6: Choose the reason for filing ITR

- Step 7: Add Bank Account Details and Other Information

- Step 8: e-Verify ITR

Step 1: Go to visit the Income Tax e-filing website using the following link:https://www.incometax.gov.in/iec/foportal/

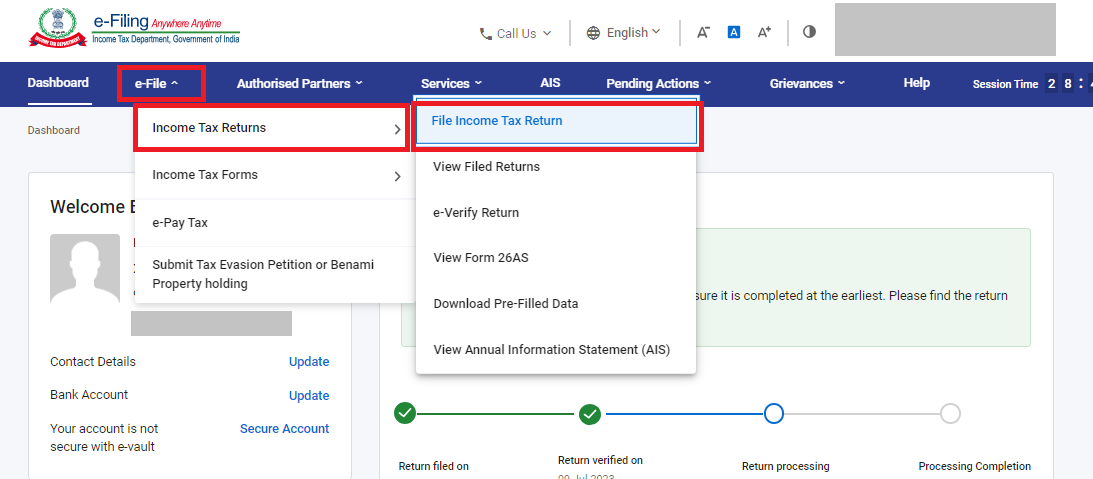

Step 2: Go to ‘File Income Tax Return’

- Click on the ‘e-File’ tab > ‘Income Tax Returns’ >then select ‘File Income Tax Return’

Step 3: Select the right ‘Assessment Year’

Select ‘Assessment Year’ as ‘AY 2022-23’ and mode of filing as ‘Online’

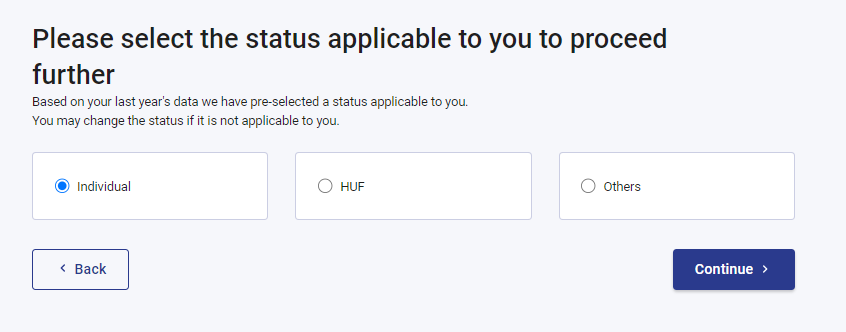

Step 4: Select status

Select your filing status: Individual, HUF, or Others. Select Opt for ‘Individual’ and ‘Continue’.

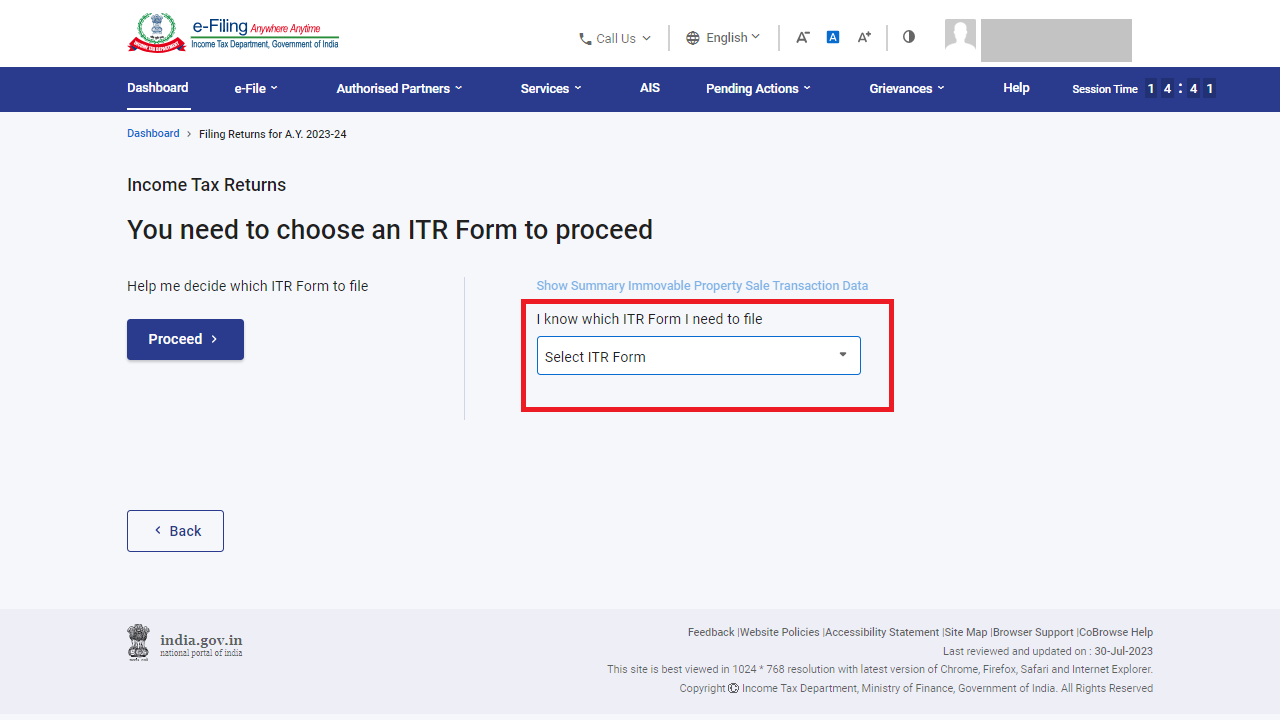

Step 5: Select ITR type

The select ITR type.The taxpayer must first ascertain which ITR form they must fill out before proceeding to file returns. There are a total 7 ITR forms.

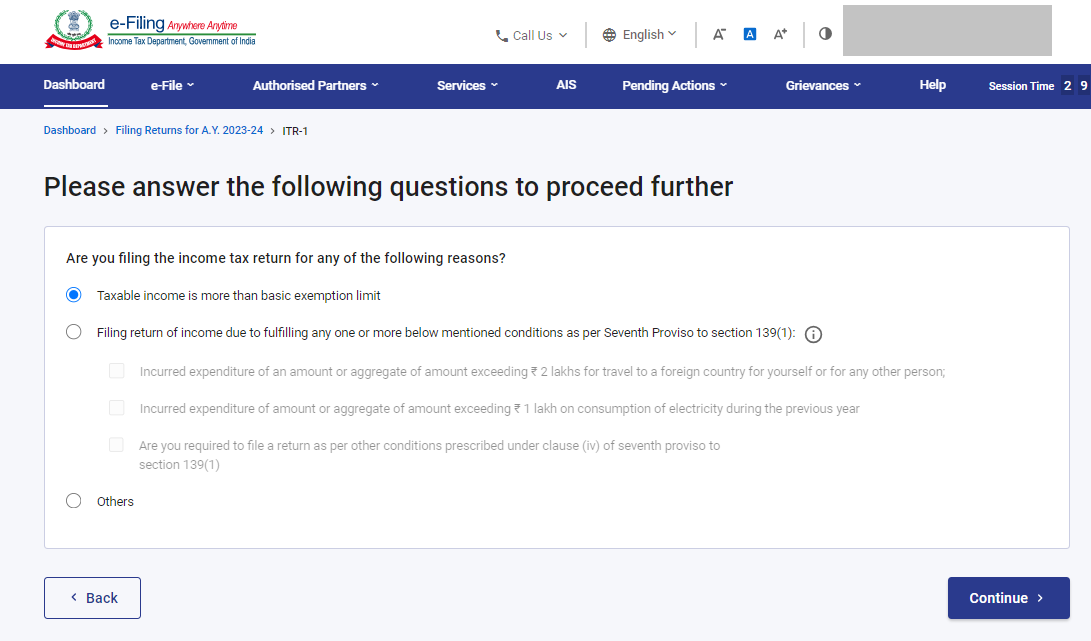

Step 6: Choose the reason for filing ITR

The following step, you will be prompted to specify the reason for filing your returns. Select the option that is applicable to your situation:

- The Specific criteria and mandatorily required to file ITR

- The Taxable income is more than basic exemption limit.

- Others

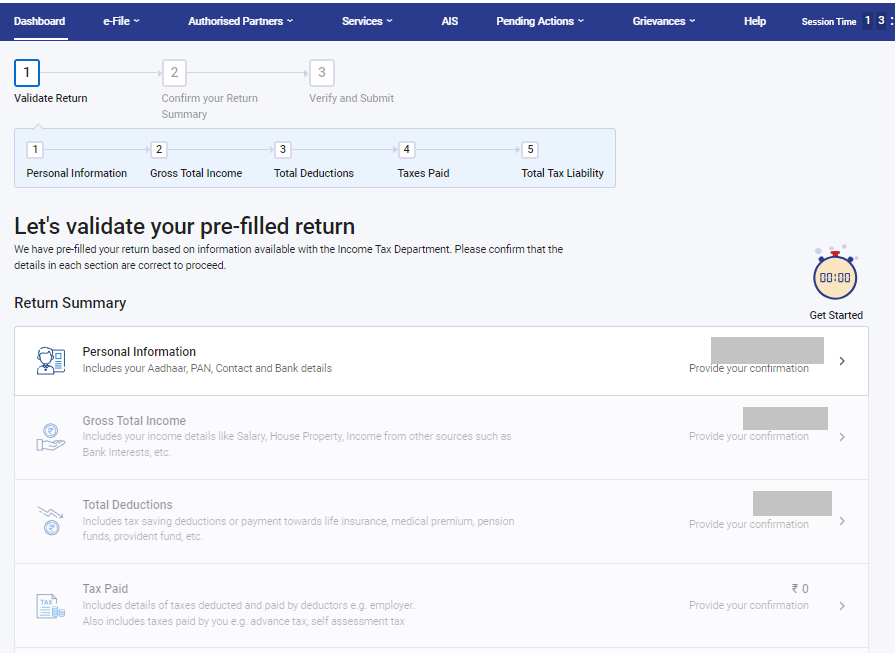

Step 7: Add Bank Account Details and Other personal Information.

Provide your bank account details . If you have already provided these details, ensure they are pre-validate. You will seen a new page which will have most of your details pre-filled. Re check the information carefully to ensure it is correct. Confirm the summary of your returns and valid the details.

Step 8: e-Verify ITR

The last and crucial step is to verify your returns . Failing to verify your returns is equivalent to not filing it at all. You have the option to e-verify your returns using different methods such as Aadhaar OTP, Net Banking ,electronic verification code (EVC), or by sending a physical copy of ITR-V to CPC, Bengaluru.

Why is income tax return filing important?

Income tax return filing is important for several reasons:

- Legal Requirement: In many countries, including the United States, it is a legal requirement for individuals and businesses to file income tax returns.

- Revenue Generation: Income tax is a source of revenue for governments. It helps fund public services, infrastructure development, social welfare programs, and other essential services that benefit society as a whole.

- Transparent Financial System: Income tax return filing contributes to a transparent financial system by documenting and recording financial transactions.

- Wealth Distribution: The tax system is designed to redistribute wealth by imposing higher taxes on those with higher incomes. Income tax return filing ensures that the government can assess individuals’ and businesses’ financial status and apply progressive tax rates accordingly.

- Social Welfare Programs: Governments utilize tax revenue to fund social welfare programs, including healthcare, education, and unemployment benefits.

- Credit and Financial Transactions: Many financial institutions, when considering loan applications or financial transactions, may require proof of income, which is often provided through income tax returns.

- Avoiding Penalties: Timely and accurate filing of income tax returns helps individuals and businesses avoid penalties and legal consequences. Late or incorrect filings may result in fines, interest charges, or other punitive measures.

- Claiming Refunds: If you have overpaid taxes during the year, filing a tax return allows you to claim a refund. This can be especially important for individuals and businesses looking to maximize their financial resources.

- Planning for the Future: Analyzing income and expenses while preparing tax returns can help individuals and businesses make informed financial decisions. It allows for better financial planning and management.